Over the last eighteen months, there has been much debate on the rampant increase in iron ore mining in Goa. Due to the relentless efforts of honourable activists, both in Goa and outside, the matter besieged media and social attention, raising questions about the state of affairs, the government and many large industrial houses in the state. Public has been flooded with a lot of opinion, but the multiple and varied voices have left lingering doubts in people’s minds, who may not realise they have access to data. If someone makes the effort, data is not unavailable in the public domain, and if one can make that effort, it is not difficult to analyse whether and where the impact is.

Activists and public enthusiasts have pointed out that rampant and uncontrolled growth of the industry within Goa has put tremendous pressure on Goa, stretching its infrastructure to the breaking point. This increase in production and exports of Goa origin ore from Goa, they point out, has disturbed daily life, increased pollution, jeopardised road safety, and endangered ecological balance, in general.

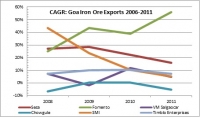

Examining the past few years’ exports data clearly indicates a marked increase in production and exports of Goan iron ore from Goa since the so-called China boom. It is interesting to note that the increase in exports in Goa is restricted to a few (or one, as the case is) players. While the growth in most players has been uniform hovering less than 10%, with the exception of Chowgule group, and other minor exporters, exhibiting negative growth, the Fomento group has recorded a stupendous 56% CAGR (compound annual growth rate) in the last five years, with a increase in exports by six-fold in Goa origin iron ore.

Compared to that, Sesa Goa, part of the Vedanta group since April 2007 has recorded a moderate growth of 16% in the same period, after considering that it has acquired the Dempo group in 2009-10. It is interesting to note further that the Fomento group has seen a growth in exports of 119% in one year when the incremental growth in Goan ore exports is 3%. In 2010-11, while overall Goan ore exports increased by 1.13 million tonnes, a marginal increase, Fomento group’s individual increase was 6.41 million tonnes.

Below is an indication of how the industry has grown in the last few years. The table below shows the previous five years’ exports from Goa and the trend lines indicate compound annual growth rate (CAGR) of the top exporter groups / companies. The analysis is based on annual data, from 2006-07 to 2010-11, published by the Goan Mineral Ore Exporters’ Association (GMOEA). As the report for 2011-12 is not yet published, it is therefore not included in the analysis, though projected exports during 2011-12 are indicated.

|

in million tonnes |

| |||||||

|

Exporter Group |

06-07 |

07-08 |

08-09 |

09-10 |

10-11 |

CAGR |

11-12 (P) | |

|

Sesa* |

4.80 |

7.53 |

10.21 |

16.01 |

15.95 |

16% |

15.00 |

|

|

Dempo* |

4.00 |

3.64 |

4.35 |

| ||||

|

Fomento |

2.00 |

2.50 |

4.11 |

5.38 |

11.79 |

56% |

8.50 |

|

|

VM Salgaocar |

3.91 |

4.20 |

3.76 |

5.48 |

4.73 |

5% |

4.00 |

|

|

Chowgule |

3.29 |

3.07 |

3.31 |

3.33 |

2.64 |

-5% |

3.00 |

|

|

SMI |

1.77 |

2.54 |

2.71 |

2.39 |

2.18 |

5% |

1.50 |

|

|

Timblo Enterprises |

1.53 |

1.64 |

1.85 |

2.06 |

2.03 |

7% |

2.50 |

|

|

Others |

9.59 |

8.31 |

7.78 |

11.04 |

7.53 |

-6% |

8.84 |

|

|

Total |

30.89 |

33.43 |

38.08 |

45.69 |

46.85 |

11% |

43.34 |

|

Source: Annual publication of Goa Mineral Exporters’ Association

* Dempo mines having been acquired by the Sesa goa in 2009, the analysis is based on cumulative figures